Ethereum price has broken below the $2,900 support with rising whale sell pressure, but upcoming Fusaka upgrade could boost sentiment.

Summary

- Ethereum trades near $2,803 after losing the $2,900 support.

- Derivatives data shows high volume and falling open interest, indicating fast position exits.

- On-chain data and whale flow point to continued sell pressure despite hopes around the Fusaka upgrade.

The second-largest cryptocurrency was trading at 2,803 at press time, down about 0.9% in the past day and roughly 5% over the week. The 30-day slide now sits near 28%, placing ETH about 43% below its all-time high of $4,946 set in August.

Market activity is picking up even as the price slips. Trading volume has climbed 46% to $30 billion in the past 24 hours, showing that traders are becoming more active. CoinGlass data also shows Ethereum (ETH) derivatives volume up 19% to $70 billion, while open interest has dropped 4%.

When volume climbs but open interest sinks, it usually means traders are unwinding positions instead of opening fresh longs or shorts.

CryptoQuant data shows a clean breakdown

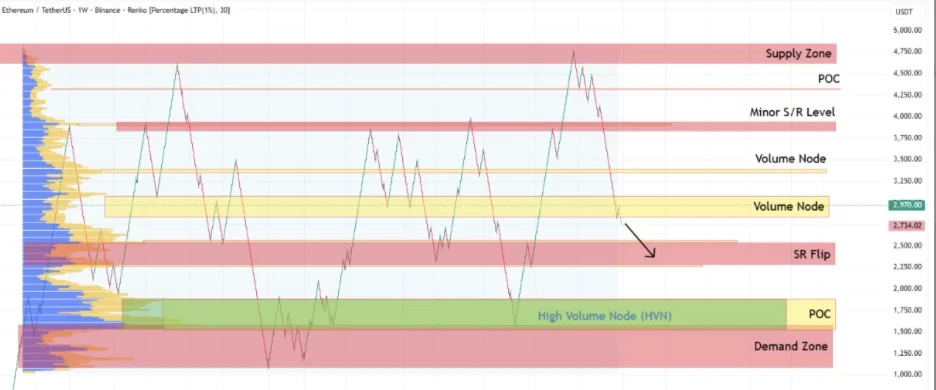

On-chain readings support the bearish technical move. According to a Dec. 2 analysis by CryptoQuant contribuetor CryptoOnchain, Ethereum has broken through the $2,900 volume node, a level that acted as a strong floor for several months.

Ethereum’s Renko chart is now clearly leaning bearish, suggesting a likely support area around $2,250. With this shift in market structure, the chances of a continued pullback have gone up.

Signals from Binance flows also support this view. The Bitcoin Exchange Whale Ratio has sharply increased, indicating that large holders account for the majority of inflows into the exchange.

When whales dominate exchange activity, it often means they are preparing for downside by selling more or increasing their hedging. Since Bitcoin usually sets the pace for the rest of the market, concentrated whale outflows there end up creating indirect pressure on Ethereum.

At the same time, declining open interest on Ethereum reinforces the idea that traders are exiting rather than defending the level that recently broke.

Fusaka upgrade may help shift sentiment

The Fusaka upgrade is set for Dec. 3 and marks an important step in Ethereum’s ongoing scaling plans. Its main goals are to reduce data load, lower the cost of rollup transactions, and make block space more efficient.

Peer Data Availability Sampling allows nodes to verify blob data without downloading the full payload, cutting resource requirements and supporting higher throughput for rollups.

Expanded blob capacity, revised fee mechanics, leaner historical data storage, and smoother proposer scheduling all work together to make the base layer faster and more predictable while lowering costs for users.

These changes help Ethereum over the long run, but they won’t necessarily undo the bearish setup we’re seeing right now. If lower fees and higher throughput bring more activity on-chain, fee burns would rise and ETH’s economic profile would improve, which could help support a recovery later on.

Ethereum price technical analysis

The chart is clearly in a downtrend, with the price stuck below all major moving averages. Both short- and long-term averages point to ongoing selling pressure. After a sharp drop, the Bollinger Bands have widened, and the relative strength index sits around 33, showing no sign of a reversal yet.

MACD is still negative even though it is trying to flatten. The commodity channel index leans neutral, while stochastic sits in the low-mid range without strong momentum.

Immediate support is near $2700 and deeper support lies around $2,250. Bulls need a clear reclaim of the 3,000 zone to shift momentum, while staying below the current range keeps the bearish path in place.