The Variational Protocol is positioning itself as a next-generation derivatives infrastructure layer — addressing the gaps in current perpetuals, futures, options, and OTC trading systems. In this article, we will discuss the Vartiational Protocol Review.

1. What is Variational Protocol?

At its core, the protocol is described as follows:

“The Variational Protocol is generalized to manage the lifecycle of peer-to-peer trading on-chain, and underpins multiple purpose-built applications.”

Rather than being just a trading app, Variational is the protocol layer — with application front-ends built on top. It automates booking, clearing, and settlement of derivatives trades. Additionally, it supports “perpetuals and generalized derivatives” — not just standard futures, but custom instruments too.

2. Key Concepts

P2P Trading Protocol vs. Traditional DEX

Unlike standard AMM-based DEXs, Variational operates as a peer-to-peer (P2P) trading network. Each trade is executed directly between counterparties via smart contract, enabling custom derivatives, low slippage, and transparent on-chain settlement without intermediaries.

Trading via RFQ (Request-for-Quote)

The platform leverages an RFQ model where traders request and receive quotes from liquidity providers in real-time. This institutional-grade structure enhances execution precision, minimizes front-running risk, and allows customized derivative parameters beyond typical perpetuals.

Variational Oracle – Low-Latency, Verified Pricing

The Variational Oracle aggregates high-quality pricing data from both CEXs and DEXs. It ensures fair-value execution, accurate margining, and stable funding rates — providing traders with dependable, manipulation-resistant market data at every tick.

Settlement Pools – On-Chain Counterparty Backbone

Settlement Pools function as liquidity and clearing hubs that secure collateral for active trades. These smart-contract pools automate profit and loss settlement, manage counterparty exposure, and isolate risk to preserve systemic stability.

3. Foundational Architecture

Core Components

The protocol is composed of modular smart contracts for pricing, margining, settlement, and liquidation. Each component — from the Pricing Oracle to the Margin & Liquidation Engine — operates autonomously but synchronizes through Variational’s transaction handler for seamless on-chain execution.

Application Layer

- Omni: Retail-focused perpetuals trading platform featuring zero fees, deep OLP-backed liquidity, and hundreds of supported markets.

- Pro: Institutional platform for customizable derivatives and margin structures, providing on-chain settlement and risk segregation for professional traders.

Tokenomics & Ecosystem

The upcoming $VAR Token (launching in 2025) will serve as the protocol’s utility and governance asset. At least 30% of all protocol revenue will feed back into the token, aligning long-term growth with community incentives.

3. Products & Features

Omni (Retail Perpetuals)

Zero Trading Fees – Accessibility Without Friction

Omni eliminates maker and taker fees entirely, allowing traders to open and close positions without incremental cost. This fee-free model promotes higher volume, improves capital efficiency, and supports sustainable growth for high-frequency and retail participants alike.

Loss-Refund Mechanism – Incentivized Trading Experience

A unique probabilistic refund feature randomly reimburses a portion of losing trades, creating an engaging trading experience while softening downside risk. This gamified model encourages user retention and sustained activity without distorting the underlying market dynamics.

OLP Liquidity Vault – Deep Aggregated Market Depth

The Omni Liquidity Provider (OLP) vault consolidates liquidity across DEXs, CEXs, and OTC sources, ensuring seamless execution with minimal slippage. It serves as the backbone of the trading ecosystem, providing continuous depth for all supported markets.

Extensive Market Coverage – Hundreds of Tradable Pairs

Omni supports a broad array of perpetual and derivative markets, including BTC, ETH, SOL, and emerging assets. Its rapid listing engine enables fast market deployment, allowing traders to capture early opportunities across sectors and asset classes.

3. Pro (Institutional / OTC Derivatives)

Custom Derivative Creation – Tailored Financial Engineering

Pro enables institutions to design bespoke derivatives with configurable strike, expiry, and margin parameters. This flexibility mirrors traditional OTC structuring while maintaining the transparency and security of on-chain settlement, bridging CeFi precision with DeFi autonomy.

On-Chain Escrow – Segregated Collateral Custody

Collateral for institutional positions is locked within smart contracts to ensure transparency and risk management. This trust-minimized escrow architecture eliminates counterparty exposure while preserving real-time verifiability and compliance-friendly custody practices.

Automated Booking & Clearing – Streamlined Lifecycle Management

The platform automates every stage of trade management, from creation to settlement. This reduces operational burden, removes manual reconciliation, and ensures deterministic clearing — providing institutions with scalable and auditable trade infrastructure.

API & Integrations

Professional Trading API – Institutional-Grade Connectivity

Variational provides a secure HMAC-authenticated API optimized for high-frequency trading. The API offers full access to order management, data feeds, and risk metrics, enabling developers and quant funds to deploy automated strategies seamlessly across Variational markets.

Comprehensive Instrument Support – Unified Market Interface

The API supports perpetuals, dated futures, and options through a standardized interface. This unified model simplifies integration for trading systems, allowing direct cross-market execution and data aggregation across multiple asset classes.

Real-Time Market Data – Programmatic Transparency and Analytics

Developers gain access to live pricing, margin, and liquidity data in real-time. By exposing protocol-level analytics, Variational empowers external dashboards, trading bots, and risk monitors to operate with low latency and full data transparency.

Token & Incentives

$VAR Token – Utility and Governance Core

The upcoming $VAR token underpins governance, fee-sharing, and future staking mechanisms. With at least 30% of protocol revenue allocated to token utility, it forms the foundation of long-term value accrual within the Variational ecosystem.

Incentive Layer – Community Growth Engine

Upcoming programs such as points systems, referrals, and yield multipliers will reward both traders and liquidity providers. These incentive models align user engagement with protocol growth, encouraging retention and reinforcing Variational’s user-driven token economy.

OLP Yield Vaults – Passive Liquidity Income

Future yield vaults will allow users to stake capital into OLP strategies, earning proportional returns from trading fees and funding revenue. This transforms passive liquidity into an income-generating asset while stabilizing ecosystem-wide liquidity flows.

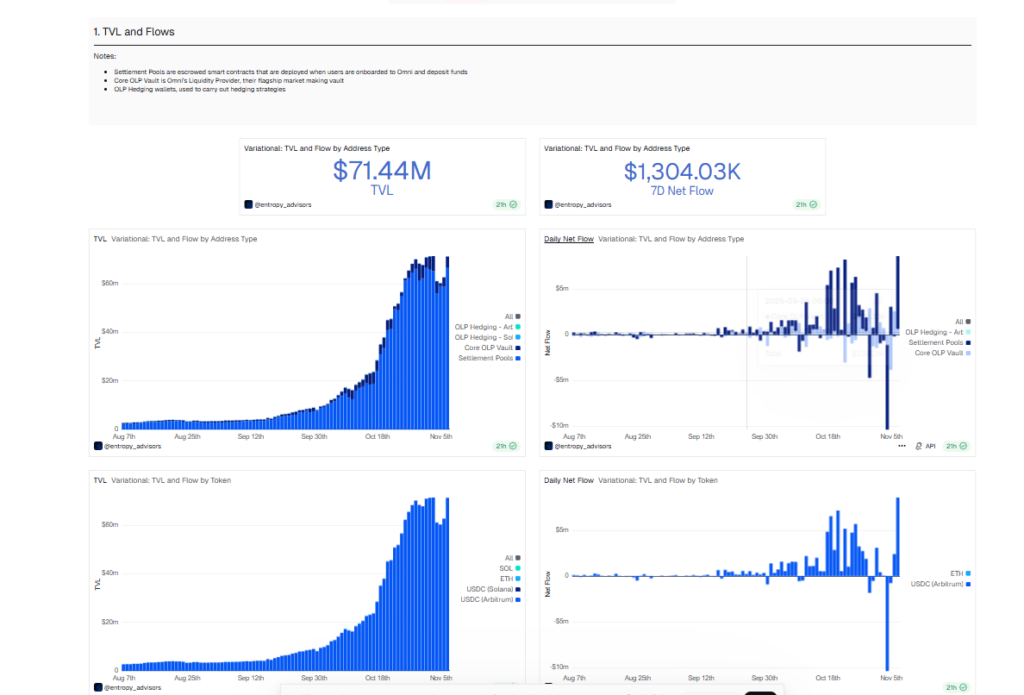

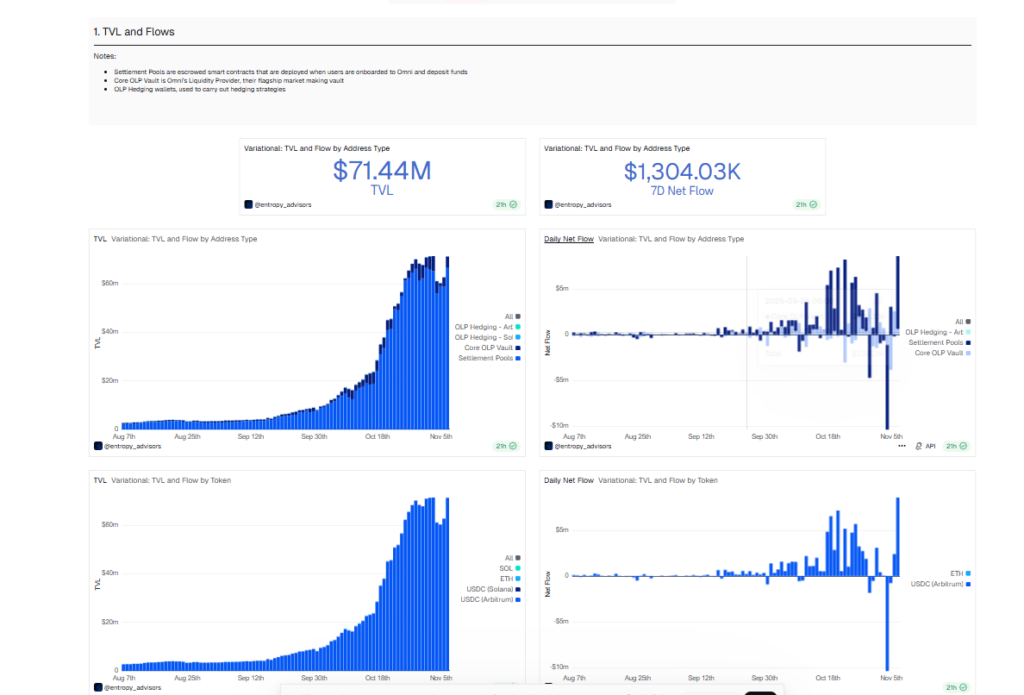

4. Data Insights: TVL and On-Chain Flows

According to the latest Dune Analytics dashboard, Variational’s on-chain footprint now mirrors that of mid-tier perpetuals DEXs, with strong signs of maturing liquidity, institutional activity, and retention stability.

Key Metrics

- Total Value Locked (TVL): $71.44 million

- 7-Day Net Flow: +$1.30 million

- Data Range: August → November 2025

Growth Trajectory

- TVL has grown exponentially since early August, with the most rapid acceleration between late September and mid-October, indicating strong adoption of Omni’s liquidity and settlement pools.

- Even after short-term fluctuations, TVL remains stable above $70 million — a healthy retention signal for both retail and institutional liquidity providers.

Vault Composition

- The majority of capital resides in Core OLP Vaults and Settlement Pools, confirming active use of both market-making and hedging strategies.

- Separate tracking of OLP Hedging Active/Sub accounts shows systematic deployment of hedging capital — a key indicator of professional liquidity operations.

5. Security & Audits

Before its private mainnet launch, Variational Protocol completed dual security audits with Zellic and Spearbit, ensuring Omni’s contracts and integrations met top-tier security standards.

Zellic reviewed core smart contracts and settlement mechanics, while Spearbit assessed front-end and API-level integrations.

Both audits confirmed the system’s robustness and adherence to DeFi security best practices. Variational continues ongoing monitoring and will publish audit summaries, reinforcing transparency and trust as core pillars of its design.

Variational Protocol stands out as a sophisticated, high-integrity foundation for decentralized derivatives trading. Its dual structure — Omni for retail and Pro for institutions — offers both accessibility and flexibility, while its consistent liquidity growth and verified security set it apart from competitors. With a $71M+ TVL, growing adoption, and a 2025 $VAR token launch on the horizon, Variational is positioned to become one of the defining infrastructure layers in on-chain finance — bridging traditional derivatives precision with DeFi transparency and autonomy.

Is Variational Protocol live for public trading?

Currently, Variational is in its private mainnet phase, focusing on performance validation and liquidity onboarding. Public access for retail users through Omni and institutional onboarding via Pro are expected in subsequent mainnet stages.

What blockchains does Variational operate on?

The protocol is multi-chain compatible, with early deployments and testing on Arbitrum and Solana. This cross-chain foundation enables flexible liquidity movement and broader asset coverage across ecosystems.

What’s next on Variational’s roadmap?

Upcoming milestones include gasless trading, expansion of Omni’s markets, introduction of OLP yield vaults, public referral programs, and further multi-chain deployments. The $VAR token launch will align with these broader ecosystem upgrades.