Chainlink’s price has crashed over the past few months, mirroring the performance of most altcoins.

Chainlink (LINK), the largest oracle network in the cryptocurrency industry, is trading at $13.12, down 26% from its May high and 57% below its November peak.

The decline comes despite several notable developments in recent weeks. Chainlink recently launched a major partnership with Mastercard, the world’s second-largest payment processor.

The partnership will enable users to purchase crypto directly using their cards, with Chainlink providing verification and synchronization solutions. Other companies involved in the initiative include Shift4 Payments and Uniswap (UNI).

Chainlink is also expected to play a growing role in the stablecoin sector through its Proof of Reserve solution, which allows companies to provide accurate, on-chain verification of their reserves.

Meanwhile, the company continues to secure partnerships with major global institutions. Chainlink now counts JPMorgan, UBS, Swift, and ANZ Bank among its collaborators.

In a statement on July 2, the company announced a partnership with Aktionariat, an equity tokenization platform with over 300,000 registered investors. The Swiss firm is using Chainlink’s Cross-Chain Interoperability Protocol to enable secure, cross-chain treasury accounts.

Chainlink also joined the xStocks Alliance, becoming its official oracle provider. Other members include Kraken, Solana, Alchemy Pay, Jupiter, and Raydium. Chainlink’s oracle infrastructure will support tokenized stock offerings for global investors.

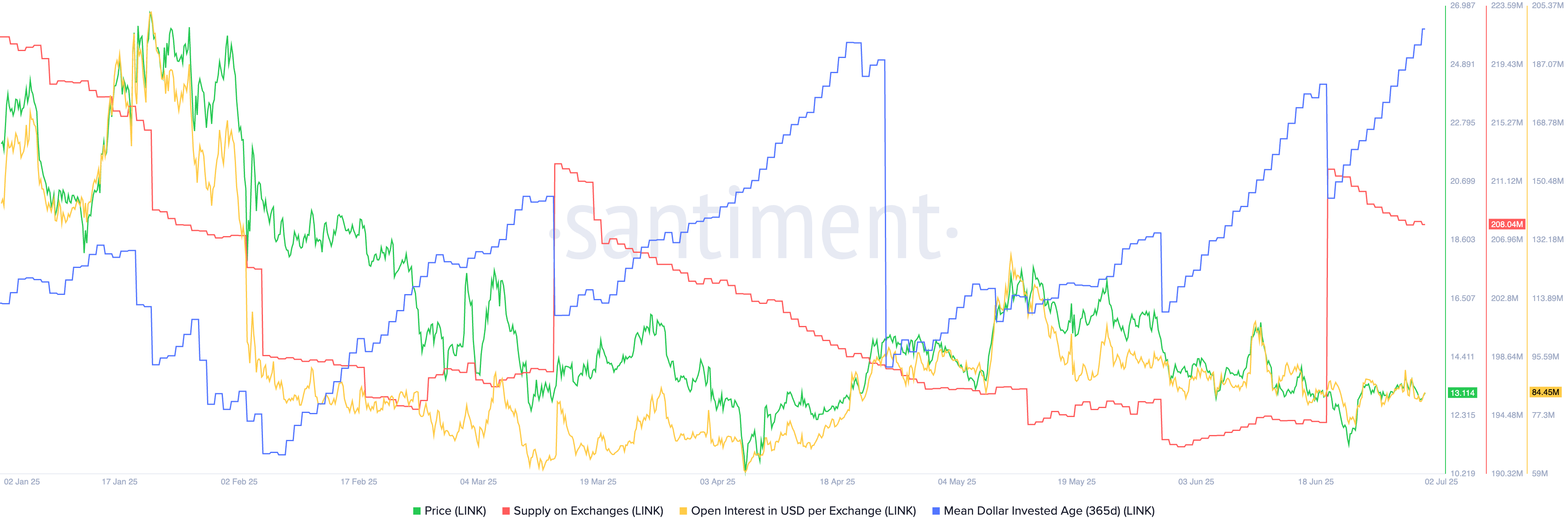

On-chain data remains supportive of Chainlink. According to Santiment, the number of LINK tokens held on exchanges has dropped to 208 million, down from 212 million last month. This decline is noteworthy, as it follows a surge in volume during June.

In addition, the Mean Dollar Invested Age (known simply as MDIA) has continued to rise, hitting 129.50, up from 110 in April. A rising MDIA indicates that investors are holding their tokens longer, a historically bullish signal.

Chainlink price technical analysis

The daily chart shows that LINK is flashing mixed signals. On the bullish side, the token has formed a double-bottom pattern at $10.90, with a neckline at $17.90.

A double bottom is typically seen as a strong reversal signal. If confirmed, the initial upside target would be $17.90, followed by the psychological resistance level at $20.

However, LINK remains below both the 50-day and 100-day Exponential Moving Averages, indicating that the broader bearish trend is still intact. It has also formed an inverse cup-and-handle pattern, with the current structure developing the handle.

If the price confirms the inverse cup-and-handle instead of the double bottom, a further breakdown toward $10 becomes likely.

The key level to watch is $10.91, which serves as both the double-bottom support and the lower bound of the potential inverse cup-and-handle. A break below this level would confirm a bearish continuation.