Polymarket has emerged as one of the most active decentralised prediction market platforms, attracting traders who seek to profit from real-world events ranging from politics and economics to sports and technology. While many participants place casual bets, consistently earning more on Polymarket requires a structured approach. Profitable traders focus on information quality, execution timing, and disciplined risk management, rather than relying solely on intuition. This guide explains how traders can improve their results on Polymarket by combining data, tools, and proven strategies.

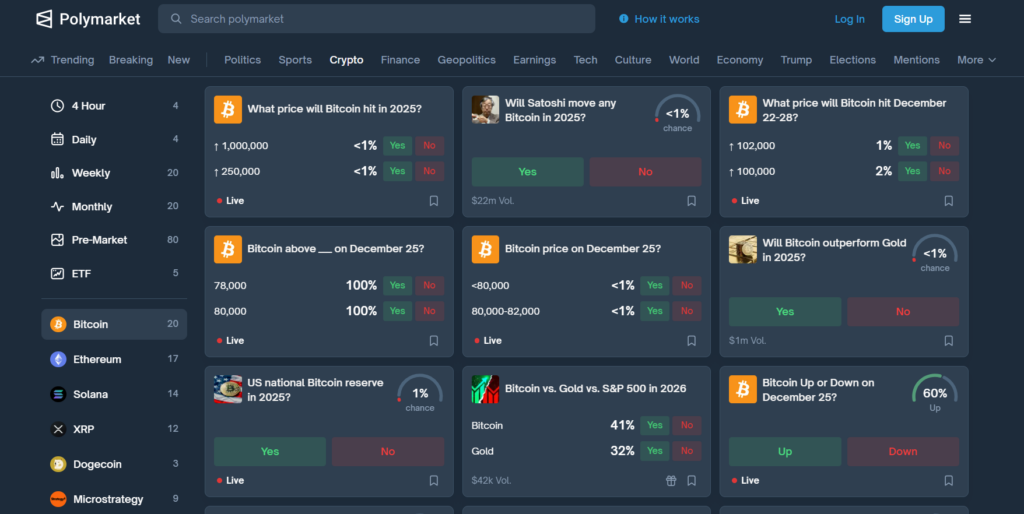

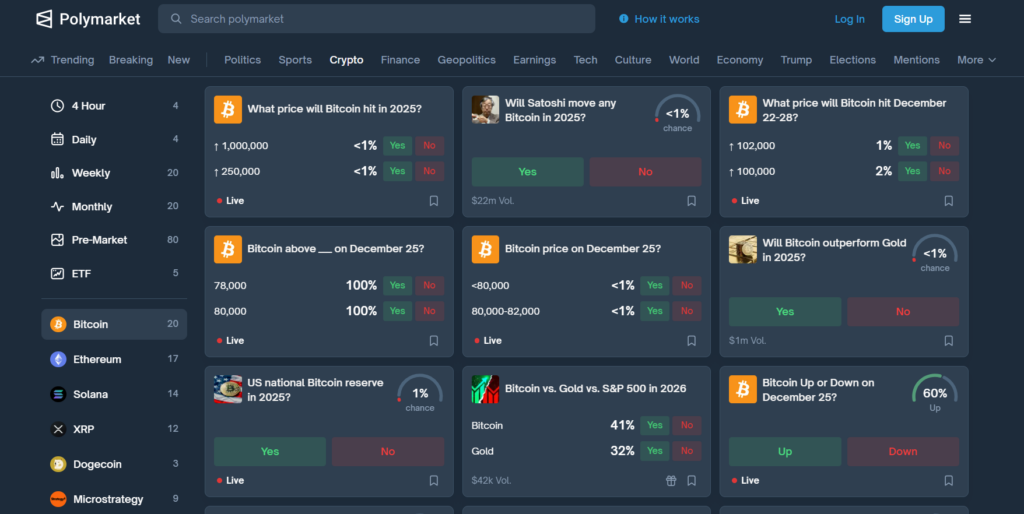

How Polymarket Pricing Really Works

Polymarket prices represent implied probabilities. A YES share priced at 65¢ implies a 65% chance of the event occurring, while a NO share priced at 35¢ reflects the opposite outcome. Markets move as traders update their beliefs based on new information, changes in liquidity, and shifts in order flow.

Importantly, being “right” is not enough to earn more. Profit depends on entry price, exit timing, and liquidity. A trader who buys early at 40¢ and sells later at 60¢ may outperform someone who buys at 70¢ even if both end up correct. Understanding how probabilities shift—and when markets overreact or lag—is fundamental to improving returns.

Core Ways to Earn More on Polymarket

Build an Information Edge

The most consistent profits on Polymarket come from having better or faster information than the average trader. This includes the following primary news sources, official announcements, data releases, polls, and on-chain activity. Markets often lag behind breaking information, especially outside peak trading hours.

Equally important is knowing when not to trade. Many traders lose money reacting to headlines that are already priced in. An information edge is not about trading more often—it is about trading when the market is genuinely mispriced.

Follow Smart Money and Proven Traders

Because Polymarket is fully transparent, every trade is publicly visible on-chain. This makes it possible to identify wallets that consistently trade well across multiple markets. Following these traders—rather than one-off winners—can significantly improve decision-making.

Successful traders evaluate wallets based on consistency, sample size, and risk behaviour rather than single big wins. Some traders manually track these wallets, while others use tools and bots to receive alerts or automate copying. Regardless of method, the goal is to learn from proven behaviour rather than guessing outcomes.

Enter Early and Exit Strategically

Many profitable opportunities appear early, when markets are newly launched, and liquidity is thin. Early entrants often benefit from mispriced probabilities before broader participation corrects the market.

Exiting is just as important as entering. Holding positions until resolution is not always optimal. Partial exits allow traders to lock in profits while maintaining upside exposure. As events near resolution, volatility increases, and disciplined option strategies often outperform all-or-nothing approaches.

Using Robin Markets to Improve Profitability

Discover Mispriced Markets with robin.markets

Robin Markets is a market intelligence platform designed specifically for Polymarket traders. It helps users identify trending markets, shifts in liquidity, and unusual price movements that may signal mispricing.

Scanning multiple markets at once, it allows traders to quickly spot where capital is flowing and which events are attracting informed participation. This makes it easier to find opportunities that are overlooked by casual traders who focus on only a few headline markets.

Time Trades Using Robin Markets Data

Beyond discovery, Robin Markets is valuable for timing. Monitoring changes in volume, liquidity, and price momentum helps traders understand when to enter or exit a position.

For example, a sudden increase in volume without a major news catalyst may indicate early positioning by informed traders. When combined with external news or data, these signals can significantly improve entry timing and reduce slippage.

Advanced Trading Techniques

Copy Trading with Bots and Tools

Copy trading allows users to replicate trades from profitable wallets either automatically or through alerts. Automated tools offer speed and remove emotional bias, while alert-based tools give traders discretion over execution.

Using multiple copy trading sources and limiting position sizes helps reduce dependency on any single trader. Copy trading is most effective when combined with independent judgment rather than blind automation.

Scalping and Short-Term Opportunities

Scalping focuses on small price movements rather than full event resolution. High-liquidity markets often oscillate as traders enter and exit positions, creating opportunities for short-term gains.

This approach requires discipline and speed. Overtrading, especially in low-liquidity markets, can quickly erase gains. Scalping is best suited for traders who actively monitor markets and use data-driven alerts.

Arbitrage Strategies on Polymarket

Arbitrage opportunities arise when probabilities are inconsistent across related markets or outcomes. Examples include overlapping political events or logically linked outcomes priced inconsistently.

While arbitrage can be low-risk in theory, execution speed and liquidity are critical. Delays or partial fills can turn a theoretical edge into a loss. Traders should approach arbitrage cautiously and size positions conservatively.

Risk Management: Keeping Your Profits

Earning more on Polymarket is as much about preserving capital as it is about finding opportunities. Effective traders use consistent position sizing, avoid overexposure to single narratives, and respect liquidity constraints.

Binary outcomes amplify risk, and emotional decisions—such as chasing losses or doubling down—are common causes of drawdowns. A clear plan for maximum exposure per trade and per market is essential for long-term success.

Common Mistakes That Limit Earnings

Many traders reduce their profitability by entering trades too late, blindly copying others without evaluation, or holding positions without an exit plan. Overconfidence after short-term wins often leads to larger losses later.

Another frequent mistake is ignoring liquidity. Even correct predictions can lose money if exits are poorly timed or markets are too thin to support position sizes.

Building a Sustainable Polymarket Strategy

Consistent profitability on Polymarket comes from combining multiple approaches. Successful traders often blend information-based trades, copy trading, and data-driven tools like robin.markets into a repeatable process.

Tracking performance, reviewing past trades, and refining strategies over time are critical. Polymarket rewards patience, discipline, and adaptability more than bold predictions.

Conclusion

Earning more from Polymarket is not about predicting outcomes better than everyone else—it is about understanding probabilities, acting faster on quality information, and managing risk effectively. Tools like robin.markets, smart-wallet tracking, and copy trading bots provide a structural advantage when used correctly. By combining these tools with disciplined execution and continuous learning, traders can consistently outperform the average Polymarket participant.

Frequently Asked Questions (FAQs)

Can you realistically earn consistent profits on Polymarket?

Yes, but consistency requires discipline. Profitable traders focus on mispriced probabilities, early entries, proper exits, and risk management rather than guessing outcomes. Using data tools and tracking performance over time significantly improves results.

Is it better to hold positions until resolution or exit early?

It depends on the situation. Holding until resolution can maximize returns if liquidity remains strong, but exiting early often reduces risk and locks in profits. Many experienced traders use partial exits to balance upside and volatility.

How does robin.markets help traders earn more?

robin.markets helps traders identify trending markets, liquidity shifts, and unusual price movements across Polymarket. This allows users to discover mispriced opportunities earlier and time entries and exits more effectively.

Are copy trading tools necessary to be profitable?

No, but they can improve execution speed and learning. Copy trading enables users to follow proven traders, but it works most effectively when combined with independent analysis and proper position sizing, rather than relying solely on blind automation.

What is the biggest risk traders underestimate on Polymarket?

Liquidity risk. Even correct predictions can lose money if markets are thin or exits are poorly timed. Overexposure to low-liquidity markets and emotional decision-making are common causes of losses.