All over the world, people use traditional financial services every day. However, these services are provided by big banks and always have a single point of failure.

But Blockchain-powered with smart contract technologies is changing the way we manage wealth or do finance. Today we will talk about what is DeFi (Decentralized finance).

DeFi (Definition)

DeFi is the domain of financial services built using decentralized technologies. These services are financial primates, such as lending, borrowing, swap, trading, asset management, etc.

DeFi vs. Traditional Finance

DeFi services are better than traditional finance in many ways. Let’s see some of the most important differences that make DeFi efficient and unstoppable.

No Middleman

DeFi applications are built on top of protocols with open governance models. Over time, these protocols will not be governed by any single company instead of by entities owning the tokens with real skin in the game.

It removes the profit-seeking middle man and the dependency on a single company or entity. Therefore, eliminating the chance of People failure and manipulation.

Innovation

DeFi is powered by protocols that are open and permissionless. Therefore anyone can build on top of them, which is a catalyst for innovation.

DeFi services are applications of programmable money, and developers are reinventing the finance and making it more efficient.

For example — Aave project introduced Flash loans, which are not possible in traditional finance.

No Vendor Lock-in

With traditional finance, vendor lock-in is one of the biggest problems. According to the U.S. Retail Banking Satisfaction Study, just 4% of consumers switched their primary banks in 2018.

Because of vendor lock-in, these banks upsell other financial products at higher prices. Things like credit history and other personal financial data make it more challenging to change your vendor.

DeFi applications do not impose the vendor lock-in problems by design. Because you are the custodian of your wealth, in order to switch to a different service, all you need to do it to connect your wallet.

Even when you take a loan using a protocol, innovations like Flash loans help you switch to different protocols even when you don’t have enough money.

Putting you in control of your wealth is one of the fundamentals property of blockchains.

Operating Cost

As email eradicated the need for physical post offices and reduced the operating cost and increased the efficiency and volume at the same time. Similar will happen to banks and other financial services as DeFi services will grow.

Do you remember when you went to your bank last time? I don’t.

Digital assets will replace not only the physical assets but also all the operating costs associated with it. Think, a protocol on the internet can give loans to anyone in the world without any human involvement.

Transparency

Transparency is one of the biggest problems in the financial sector. If people knew that banks were giving bad loans earlier, we could have prevented the 2008 financial crisis.

With DeFi services, you can see every transaction on the blockchain and analyze them.

Independent and Interconnected

Because of the permissionless behavior of blockchains, DeFi services are independent with no dependency other than the protocols and open source tools it uses.

At the same time, because many DeFi services use common protocols, developers are interconnecting them to enhance their usefulness and creating a full-blown financial infrastructure.

Censorship-resistance Financial Services

In 2011, the USA government ordered all financial service providers to stop providing their service to Wikileaks. Because Wikileaks released something which the government didn’t like.

Governments all over the world block economic transactions as they see fit. Blockchains solves these problems because the technology is fundamentally censorship-resistance. Besides, people are building open source tools and improving technology to have better censorship-resistance in the future.

Privacy-focused Financial Services

Traditional financial services are data silos. They take all sorts of data from personal information to your wealth-related information.

It creates vulnerability and attracts hackers. In 2017, Equifax disclosed that hackers stole the personal information of more than 143 million Americans from its servers.

DeFi fixes this problem by using decentralized technology backed by strong cryptography. Usually, DeFi services do not require KYC or registration, so even your transaction data is public, but no one knows it belongs to you.

Note: There are blockchain analysis companies that are a threat the blockchain privacy. But technological advancement will solve this problem in the future.

Example of DeFi Services

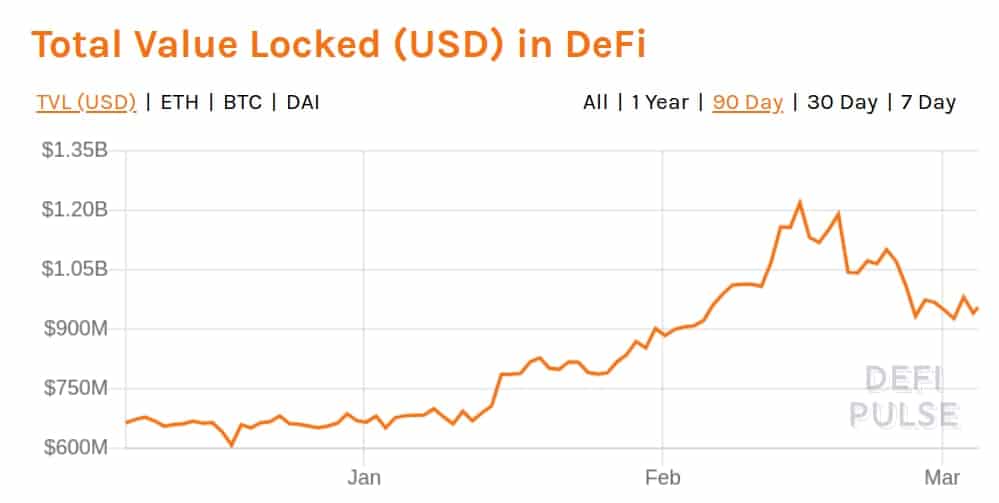

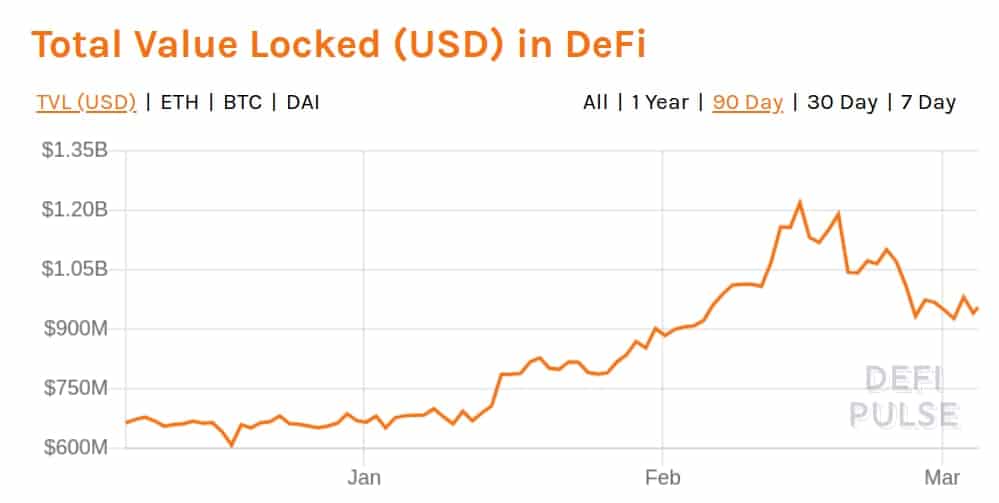

There are a lot of DeFi applications that are getting build in all financial categories. For now, the DeFi ecosystem is thriving on Ethereum blockchain. Let’s look at some of the services which you can use as an alternative to traditional finance.

DeFi Banking

DeFi banking applications integrate with multiple protocols to help you to manage and grow your crypto wealth. There are multiple types of Defi banking apps.

DeFi Lending and Borrowing

Multiple protocols enable decentralized lending and borrowing. For example, Compound and MakerDao. Check out the following applications, which will help you to interact with these protocols easily.

Crypto Exchange

If you don’t trust centralized crypto exchange services with your funds, you can use decentralized exchange services.

Insurance

There are multiple companies building insurance services to share risks. These are the alternative risk-sharing platform to secure your smart contract, digital assets, etc.

Payment

Payment is one of the biggest use cases of decentralized technologies. There are many innovative solutions that are trying to build a fast and efficient payment network to compete with companies like Visa and Paypal.

Better Personal Finance

Defi is not just decentralized; It’s also better than traditional finance. It increases efficiency by removing trusted parties and encourages innovation.

Everything is on-chain visible to everyone making DeFi transparent. Defi services are independent and interconnected, making it more powerful and flexible than traditional financial services.

Protocols like Compound give you better interest than the bank without vendor locking. In addition, you don’t have to provide your personal data to interact with DeFi apps.

DeFi is a better finance build for everyone.