The world of proprietary (prop) trading continues to evolve as traders seek flexible ways to access capital without risking their personal funds. Among the many firms in the space, Alpha Capital stands out with a clear value proposition: no evaluation time limits and training capital that can scale into the hundreds of thousands of dollars on simulated accounts. Read on this Alpha Capital Review to learn more about the firm as a proprietary trading firm.

What is Alpha Capital?

Alpha Capital Group is a UK-based proprietary trading firm headquartered in London (Company Number: 13719951). Unlike traditional retail brokers, it provides a “Simulated Institutional Environment” where traders can qualify for funded accounts.

The firm’s mission is to empower traders with professional-grade tools and capital, allowing them to keep up to 80% of the profits generated on funded accounts.

The platform distinguishes itself by offering no time limits on its evaluation challenges, meaning traders can take as long as they need to pass, provided they remain active within a 30-day window.

Also, you may read, What is Prop Trading? How does Prop Trading work?

Alpha Capital: Key Features

- Proprietary Trading Firm

Alpha Capital Group provides a simulated institutional environment where traders can qualify for funded accounts after completing an evaluation. - Multiple Evaluation Programs

The website offers several funded-account programs and account sizes through its product page, giving traders flexibility in choosing their preferred funding level. - Free Trial Account

A free trial option is available for traders who want to experience the dashboard, platforms, and trading conditions before purchasing a challenge. - Trading Platform Support

Alpha Capital Group supports multiple trading platforms, including MetaTrader 5 (MT5), cTrader, DXTrade, and TradeLocker, with availability depending on the region and account type. - Performance Fee Payouts

Qualified traders can request performance-fee payouts through supported payment methods such as bank transfers, Wise, or RiseWorks, typically processed within a few business days. - Flexible Account Sizes

Various evaluation and funded-account sizes are listed on the product page to accommodate different trader preferences. - Risk-Management Rules

Each evaluation type includes structured rules such as profit targets, maximum drawdown limits, and daily loss limits, detailed within the product and help-center pages. - No Time Limit on Evaluations

Traders are not required to complete their evaluation within a fixed number of days, as long as they remain active and do not exceed the inactivity limit. - Educational and Support Resources

The website provides help-center guides, FAQs, onboarding instructions, an economic calendar, and platform setup information to support traders.

What Alpha Capital does?

1. They Sell “Evaluations” (Auditions for Traders)

- Alpha Capital Group offers paid trading challenges where traders must prove they can trade profitably.

- You receive a demo account with rules such as profit targets and drawdown limits.

- The firm states that there are no time limits on completing evaluations, as long as you remain active.

2. They Provide Capital to Successful Traders

- When you pass the evaluation, you become a Qualified Analyst.

- You are then given access to a funded trading account with capital ranging from $5,000 up to $200,000, depending on the chosen program.

- You trade with the firm’s capital, not your own money.

3. They Pay Out Profit Splits

- When you generate profits on the funded account, you keep up to 80% of the profit.

- The firm keeps the remaining percentage as its revenue.

- If you lose money while trading a funded account, you do not owe the firm anything; you only risk the evaluation fee you originally paid.

4. They Provide Trading Infrastructure

- Alpha Capital Group provides access to multiple trading platforms, including MetaTrader 5 (MT5), cTrader, DXTrade, and TradeLocker.

- They offer educational content, help-center resources, guides, and onboarding materials to support traders.

- Traders also receive access to analytics and dashboards to track their performance.

They are a talent scout for traders. They find good traders via evaluations, back them with large accounts, and split the winnings.

Also, you may read 10 Best Options Trading Prop Firms

Alpha Capital: Trading Instruments and Conditions

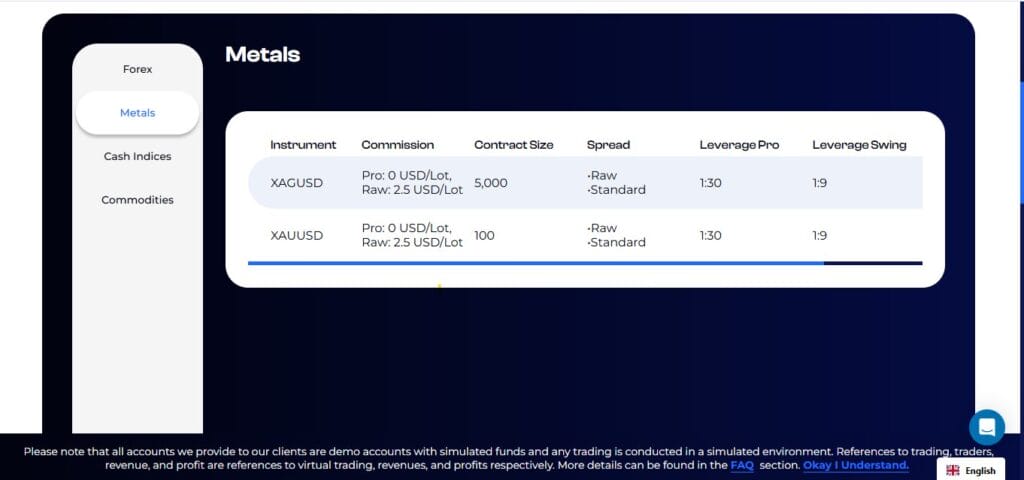

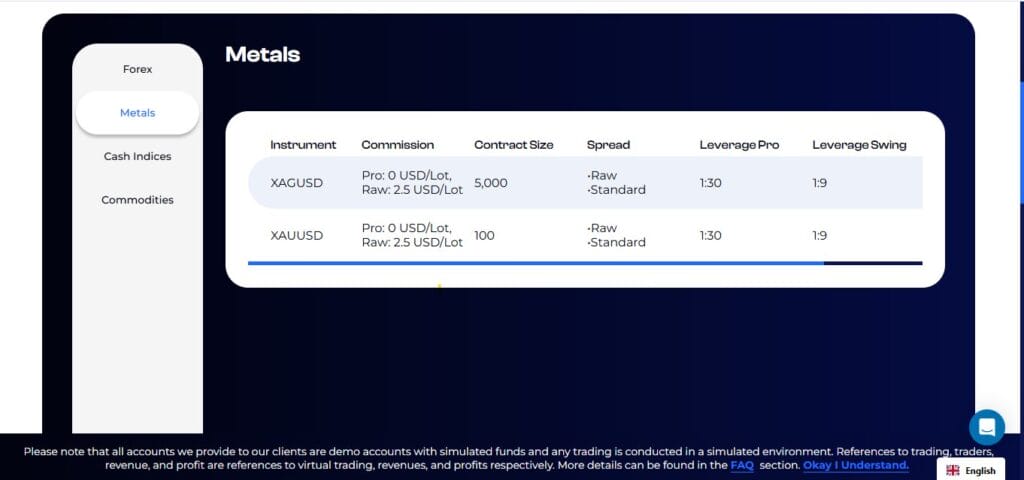

Alpha Capital Group provides traders with access to a broad selection of trading instruments, including major and minor forex pairs, metals such as gold and silver, and a variety of indices. This diverse range allows traders to participate in multiple markets and tailor their strategies across different asset classes.

- Forex pairs offer up to 1:100 leverage for pro traders, with zero commissions in pro accounts and $2.5/lot in raw accounts.

- Metals such as XAUUSD and XAGUSD come with 1:30 (pro) and 1:9 (swing) leverage, and spreads of approximately 2.5 USD/lot.

- Indices are commission-free in both account types.

Also, you may read Akuna Capital Review: Technology, Strategy and Global Market Operations

How Alpha Capital works: Evaluation process and Fee Structure

Alpha Capital Group offers multiple evaluation programs designed to assess traders’ skill, discipline, and risk management. Once a trader passes an evaluation, they receive a Qualified Analyst (funded) account, enabling them to trade with the firm’s capital under defined rules.

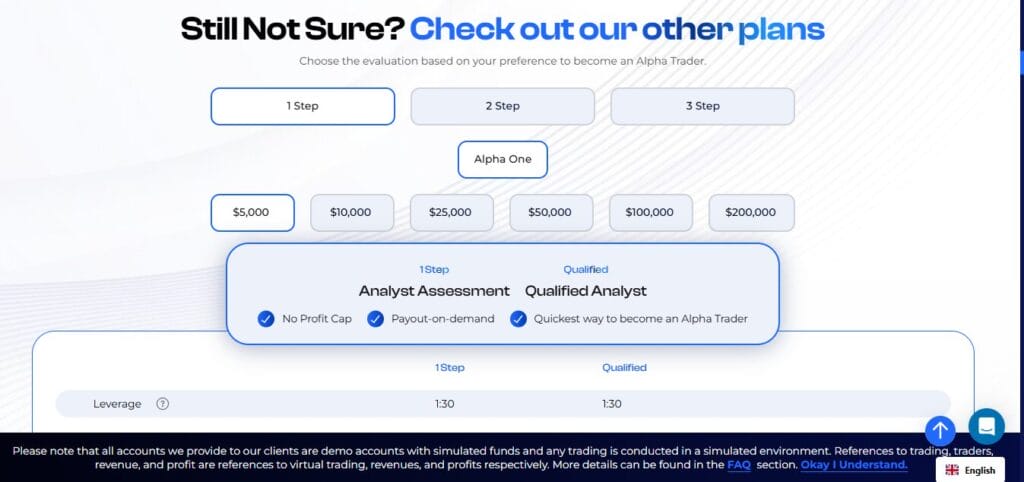

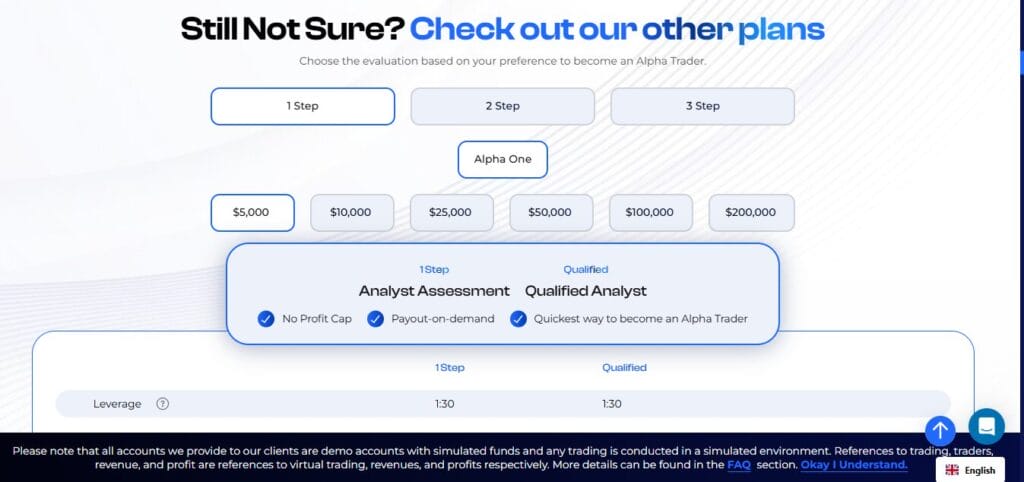

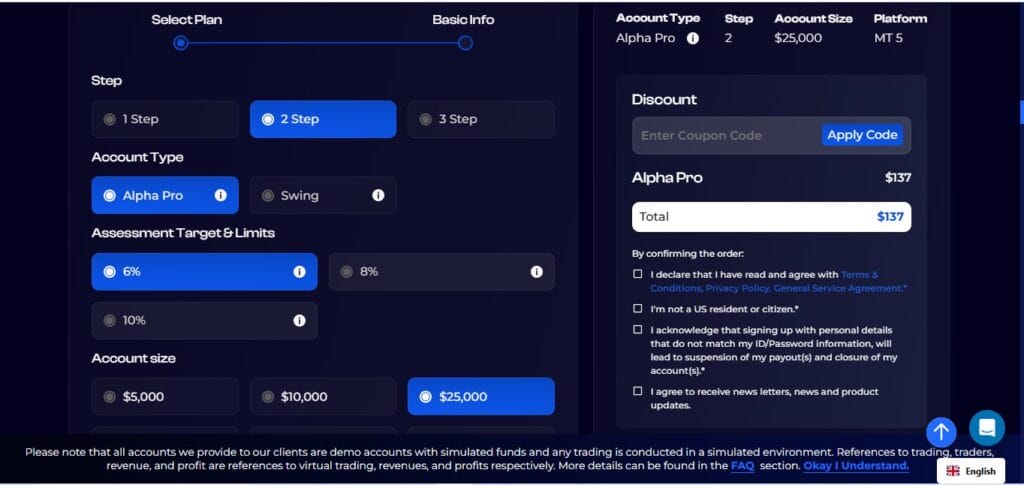

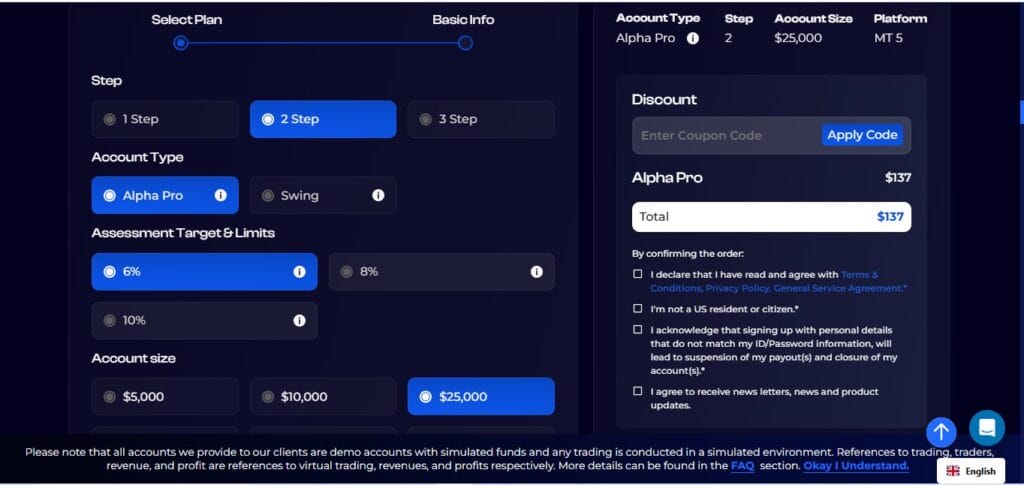

Alpha Capital Group offers three distinct evaluation plans designed to accommodate different trading styles and experience levels. Each plan features unique rules, profit targets, and trading conditions tailored to specific strategies.

The following comparison breaks down the key differences between Alpha Pro, Alpha One, and Alpha Swing.

| Feature / Rule | Alpha Pro | Alpha One | Alpha Swing |

|---|---|---|---|

| Evaluation Phases | 2 phases (Pro 8% or Pro 10% versions) | 1 phase | 2 phases |

| Profit Targets | Phase 1: 8% or 10% Phase 2: 5% | Single target: 10% | Phase 1: 10% Phase 2: 5% |

| Maximum Drawdown | Static 8% (Pro 8) or 10% (Pro 10) | 6% trailing | Static 10% |

| Daily Loss Limit | 4% (Pro 8) or 5% (Pro 10) | 4% | 5% |

| Minimum Trading Days | 3 days per phase | 1 day | 3 days per phase |

| Leverage (FX) | Up to 1:100 | Up to 1:30 | 1:30 |

| Leverage (Metals) | 1:30 | 1:9 | 1:9 |

| Leverage (Indices) | 1:20 | 1:10 | 1:10 |

| Time to Complete Evaluation | No maximum time limit | No maximum time limit | No maximum time limit |

| News Trading | Allowed with rules | Allowed with rules | Allowed |

| Weekend Holding | Allowed in assessment; limited in funded phase | Restricted in funded phase | Allowed |

| Performance Fee (Payout) | Up to 80% | Up to 80% | Up to 80% |

Alpha Pro is best for traders who prefer a structured two-phase challenge with clear risk rules, Alpha One suits confident traders who want a fast, single-phase evaluation, and Alpha Swing is ideal for those who hold trades overnight or over multiple days. This makes it easier for readers to match their trading style with the most suitable program.

Below is the latest fee information for Alpha Capital Group’s evaluation plans

| Account Size | Alpha Pro | Alpha One | Alpha Swing |

|---|---|---|---|

| $5,000 | $50 | $50 | $70 |

| $10,000 | $97 | $97 | $147 |

| $25,000 | $197 | $197 | $247 |

| $50,000 | $297 | $297 | $357 |

| $100,000 | $497 | $497 | $577 |

| $200,000 | $997 | $997 | $1,097 |

After passing the evaluation, traders receive a Qualified Analyst (Funded) Account, giving them access to Alpha Capital Group’s capital along with profit-sharing and scaling benefits as follows-

| Feature | Details |

|---|---|

| Capital Provided | $5,000 – $200,000 (based on purchased evaluation size) |

| Profit Split | Up to 80% to the trader |

| Risk Rules | Similar to evaluation rules depending on plan |

| Payouts | Withdrawable according to ACG payout schedule |

| Scaling Plan | +10% capital increase each time 10% profit is achieved |

| Platforms Available | MetaTrader 5, cTrader, DXTrade, TradeLocker |

| Trader Tools | Dashboard analytics, performance tracking, educational resources |

Also, you may read Tibra Capital Review: A Leading Global Proprietary Trading Firm

Security of Alpha Capital

Alpha Capital Group operates as a registered UK company and partners with ACG Markets, a third-party broker, to handle trade execution rather than acting as a broker itself.

The firm provides a secure dashboard environment for managing accounts and platform access, and clearly outlines all trading rules, including risk limits and the “40% Best Day Rule,” to promote transparency and consistent trading. Clearly, it outlines behaviour.

It also offers a structured scaling system that allows funded traders to request increased account sizes as they demonstrate consistent performance within the firm’s risk guidelines.

Also, you may read Best Risk Management Strategies for Crypto Trading

Alpha Capital Group vs RebelsFunding: Which Prop Firm Fits You Best?

| Feature | Alpha Capital Group (ACG) | RebelsFunding (RF) |

|---|---|---|

| Company Structure | Registered UK company; uses a third-party broker for trade execution | EU-based prop firm with its own internal structure |

| Tradable Instruments | Forex pairs, metals, indices, and other CFDs | Forex, metals, indices, energies, crypto (varies by plan) |

| Leverage | Pro accounts: up to 1:100 FX; Swing accounts: lower leverage such as 1:30 FX | Leverage varies by plan; generally higher options compared to ACG |

| Evaluation Fees | Fees scale by account size; starts around low-tier pricing | Known for lower entry costs; some plans begin around budget-friendly levels |

| Evaluation Structure | Offers 1-Step, 2-Step, and Swing-specific programs with detailed risk rules | Multiple challenge types (Copper, Bronze, Silver, etc.) with flexible structures |

| Profit Split | Up to 80% profit share for funded traders | Typically ranges from 75% to 90%, depending on the plan |

| Platform Options | MetaTrader 5, cTrader, DXTrade | Often uses its own proprietary trading platform |

| Trading Rules | Strict consistency guidelines such as the “40% Best Day Rule,” clear drawdown rules | Includes minimum trade duration rules and restrictions on certain strategies |

| Best For | Traders wanting structure, consistency, and risk clarity | Traders seeking lower-cost entries and multiple challenge formats |

Also, you may read RebelsFunding Review: A Comprehensive Analysis of a No-Time-Limit Prop Trading Firm

Partnership and Affiliate Programs

Alpha Capital Group offers a structured, three-tier affiliate program that rewards users for referring new traders.

Tier 1 (Alpha Private) pays a 6% commission with bi-weekly payouts and bonuses starting at 50 referrals.

Tier 2 (Alpha Captain) increases commissions to 8%, offers weekly payouts, and includes a $1,250 bonus when the tier is reached.

Tier 3 (Alpha Major) provides a 9% commission, on-demand payouts, a $3,000 entry bonus, exclusive merchandise, and VIP support.

This tiered system allows affiliates to earn more as they scale their referral base.

Conclusion

Alpha Capital Group provides a structured and transparent pathway for traders to access funded capital, offering multiple evaluation programs, clear risk rules, and a competitive profit-sharing model. With flexible trading platforms and defined scaling opportunities, it is a practical choice for disciplined traders looking to grow their skills and trade with firm-provided capital.

Who founded Alpha Capital Group?

Alpha Capital Group was founded by George Kohler and Andrew Blaylock.

What does Alpha Capital Group offer?

Alpha Capital Group provides evaluation programs that allow traders to qualify for funded accounts and trade using the firm’s capital.

How much profit can traders keep?

Qualified traders can earn up to 80% profit split on funded accounts.