The world of Web3 prediction markets has been rapidly expanding, offering decentralised platforms where users can forecast the outcomes of real‑world events, from political elections to sports games and beyond. These platforms enable participants to buy and sell shares that represent the probability of certain outcomes, creating a decentralised financial ecosystem. Among the leading players in this space are Polymarket, Limitless, Opinion, and Kalshi. Each platform brings its unique strengths and weaknesses, and understanding these differences can help users decide which platform aligns best with their needs. In this article, we’ll compare these four platforms across various dimensions, including features, pricing, user experience, and regulatory status.

Polymarket

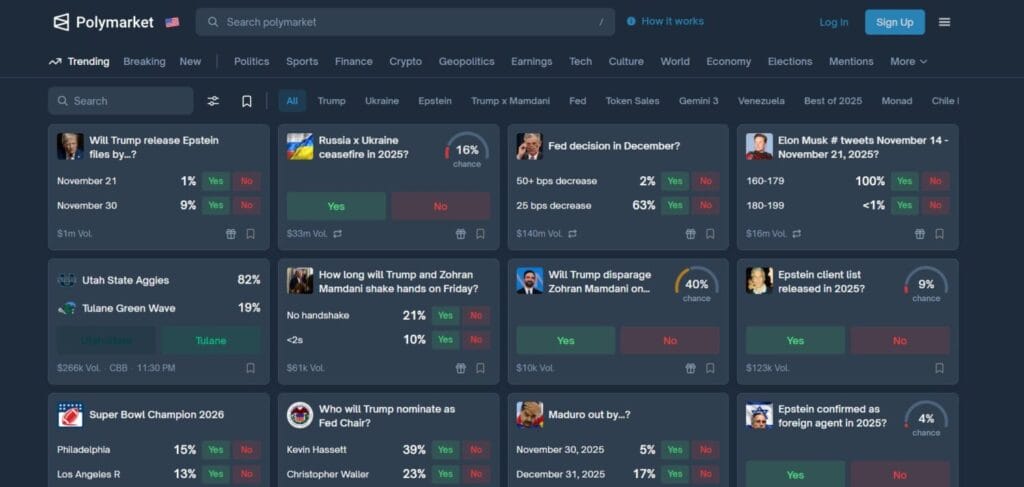

Polymarket is one of the most established and popular decentralised prediction market platforms. It allows users to bet on the outcomes of various events, such as political elections, cryptocurrency prices, or sports results. The platform utilises blockchain technology to ensure transparent and tamper‑proof market resolutions.

Key Features:

- No Platform Trading Fees: Polymarket operates without platform fees, distinguishing it from many competitors that charge trade or settlement fees.

- User‑Friendly Interface: The platform features a simple, intuitive interface, making it accessible to beginners and experienced users alike.

- Support for Crypto and Fiat: Polymarket allows account funding using both cryptocurrencies (like USDC) and fiat currency, increasing accessibility for a wider audience.

- Decentralized Market Resolution: Polymarket uses decentralised oracles to resolve markets, ensuring that the results are transparent and verifiable.

Challenges:

- Regulatory Scrutiny: Polymarket has faced regulatory challenges in certain jurisdictions. Its offerings have been compared to financial products that resemble securities, leading to potential issues in some regions.

Transaction & After‑Transaction Pricing:

- Trading Fee: 0% platform trading fee.

- Deposit/Withdrawal (Relayer) Fee: ≥ US$3 or 0.3%, whichever is greater, on certain relayer methods.

- Example: If you deposit US$100 via the relayer, you might pay US$3 as a minimum. If you withdraw US$100, again US$3 (assuming the same relayer). The platform itself takes no trade fee.

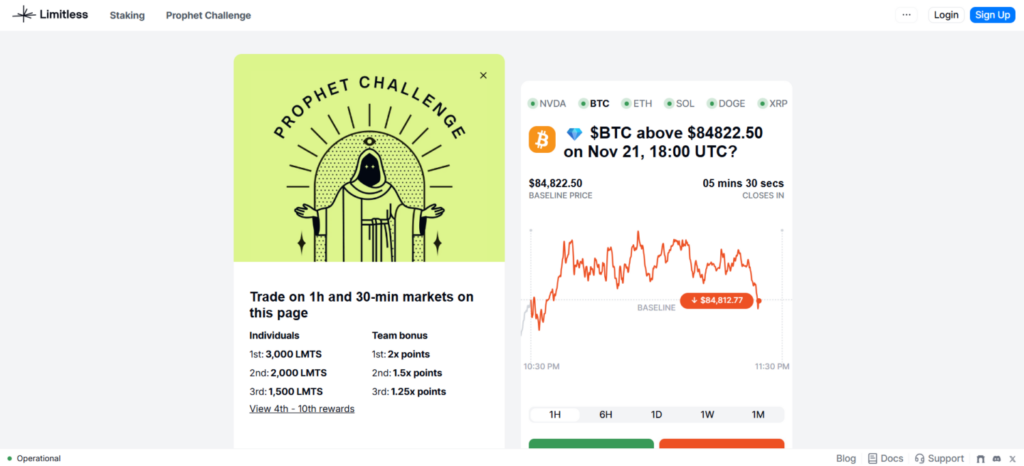

Limitless

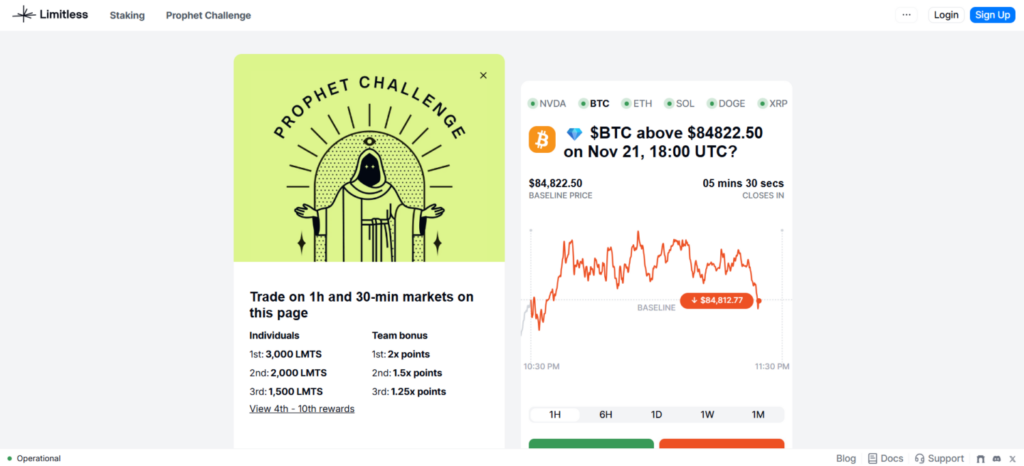

Limitless Exchange is an emerging prediction market platform that offers users the ability to trade on a variety of outcomes, from financial markets to sports and entertainment. Limitless stands out with its innovative features, including multi‑outcome markets, share‑splitting mechanics, and liquidity rewards. Built on the Base Layer‑2 protocol, Limitless offers fast transaction speeds and zero fees.

Key Features:

- Multiple Outcome Markets: Unlike many traditional prediction markets with binary outcomes (yes/no), Limitless allows markets with three or more possible outcomes, offering richer strategic possibilities.

- Liquidity Rewards: Users providing liquidity rewards to the platform’s markets can earn rewards, incentivising deeper liquidity and more participation.

- Share Splitting and Merging: One standout mechanism is share splitting/merging, allowing users to adjust their exposure dynamically.

- Built on Base L2: The Base Layer‑2 network means faster transactions and significantly reduced gas/fees compared to the Ethereum mainnet.

Challenges:

- Emerging Platform: While growth is strong, Limitless is still relatively new compared to larger players like Polymarket and may have smaller liquidity pools.

- Complexity for New Users: Some of the advanced mechanics (multi‑outcome markets, splitting shares) add a learning curve for newcomers.

Transaction & After‑Transaction Pricing:

- Platform Trading Fee: No flat “platform fee” publicly standardised; users typically pay the spread in the market + any network/transaction (gas) costs.

- After‑Transaction Costs: On Base L2 network, gas fees are very low (e.g., a few cents to a dollar) compared to Layer‑1. Liquidity providers earn a portion of trading spreads.

- Example: If you place a trade for USDC 100 on a market, your cost = trading spread (e.g., 0.5‑1%) + ~US$0.10‑US$1 in gas. Liquidity providers earn part of that spread.

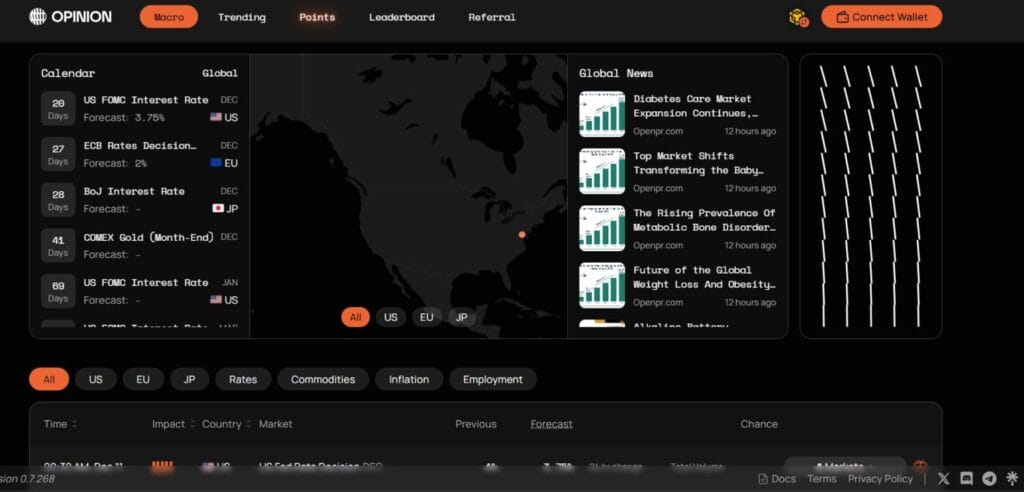

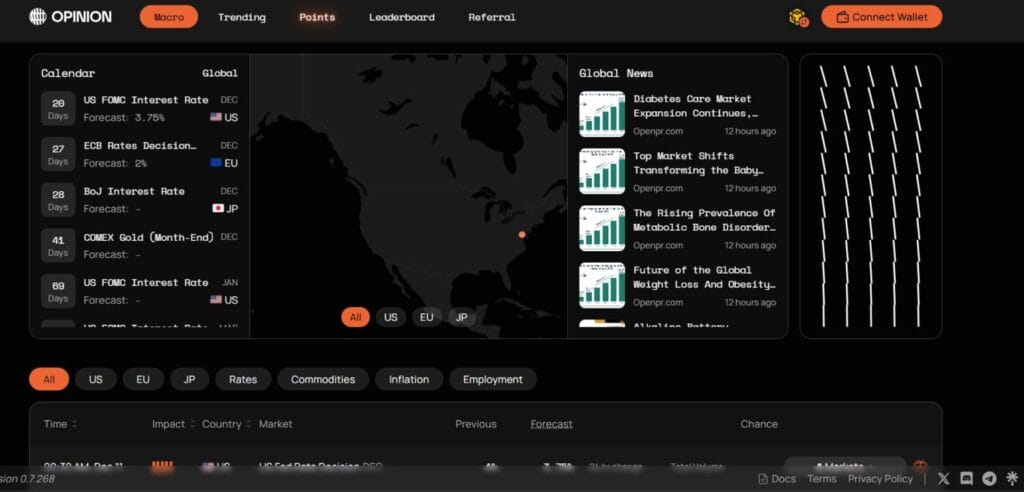

Opinion

Opinion is a relatively new entrant in the Web3 prediction market space, quickly making a name for itself with AI‑driven insights and its exclusive operation on the BNB Chain. Backed by YZi Labs, Opinion leverages artificial intelligence to offer more accurate prediction inputs and focuses on seamless, low‑cost transactions.

Key Features:

- AI‑Powered Insights: Machine‑learning models provide analytical support, helping users make more informed predictions.

- BNB Chain Integration: Operating on the BNB Chain means lower transaction costs and high throughput compared to older chains.

- Rapid Adoption: Reported 1.6 million active users, indicating strong early traction.

- Diverse Market Types: Users can participate in crypto price, political events, economic indicators, and more.

Challenges:

- Early Stage Platform: While promising, Opinion is still in an early phase and may face scalability and liquidity challenges.

- Regulatory Uncertainty: As with many Web3 platforms, regulatory clarity is still emerging in key jurisdictions.

Transaction & After‑Transaction Pricing:

- Platform Trading Fee: Not publicly well‑documented; likely low due to BNB‑chain efficiency and incentive structure.

- After‑Transaction Costs: Transaction (gas) costs on BNB Chain are typically < US$0.10‑US$1 depending on network congestion. Deposit/withdrawal fees depend on the crypto/fiat rails used.

- Example: A USDC trade of US$50 might cost a nominal fee (e.g., 0.5% or less) + ~US$0.10 in network cost. Fiat deposit/withdrawal costs vary by payment rail.

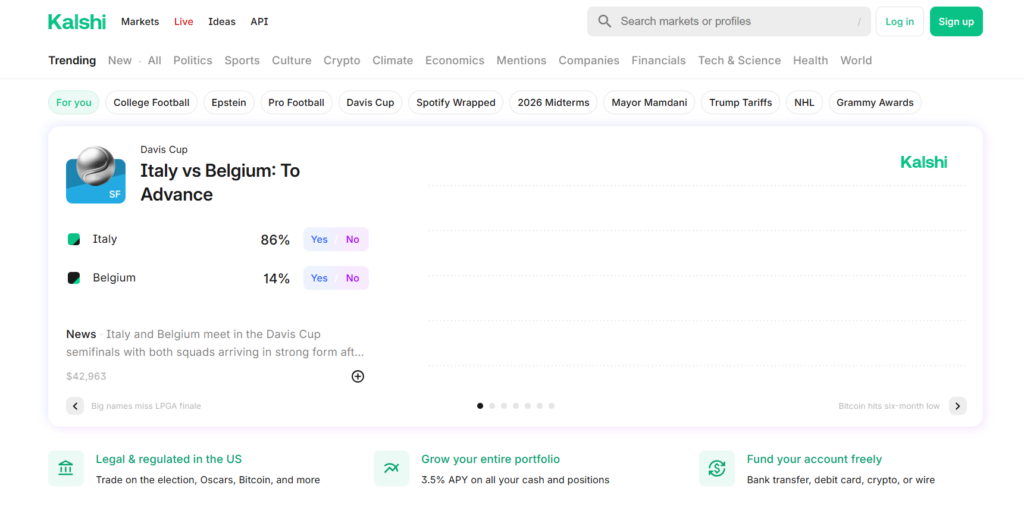

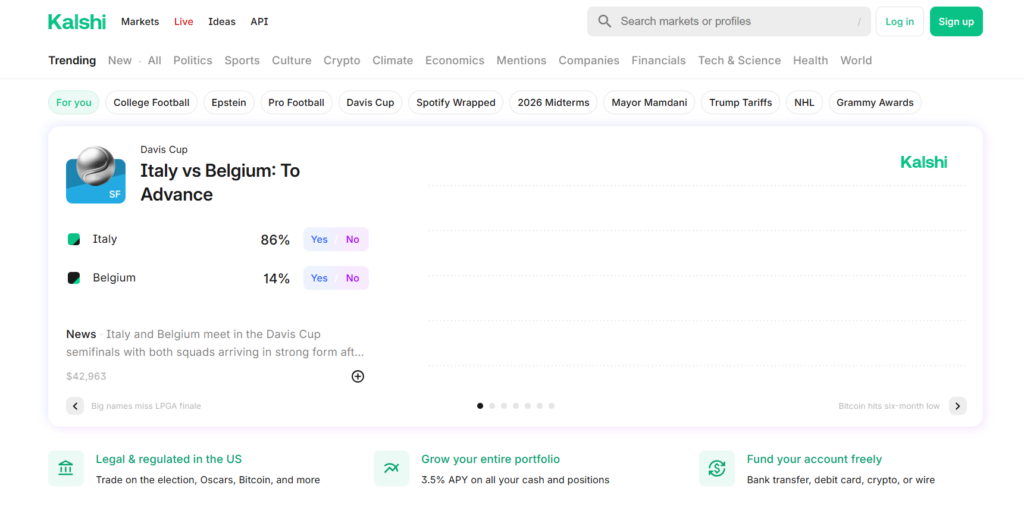

Kalshi

Kalshi is a unique player in the prediction market space: it is the first platform to be fully regulated by the U.S. Commodity Futures Trading Commission (CFTC). This regulatory oversight allows Kalshi to offer financial contracts based on real‑world events, providing a more traditional trading experience. Users trade contracts tied to economic releases, climate events, political outcomes, and more.

Key Features:

- CFTC Regulation: Kalshi operates under U.S. regulation, offering users the trust and compliance of a regulated exchange.

- Diverse Event Instruments: Markets span a range of economic indicators (e.g., unemployment numbers) to weather events, political votes, and more.

- Financial Trading Format: Rather than simple yes/no shares, Kalshi offers contracts with settlement values and financial‑style risk/reward.

Challenges:

- Limited Geographic Access: Primarily available to U.S. users; international access may be restricted by regulation.

- Higher Barrier and Fee Structure: Being regulated adds compliance overhead, which can lead to higher user costs compared to minimalist decentralised counterparts.

Transaction & After‑Transaction Pricing:

- Trading Fee: Varies by contract; typically under 2% of contract value.

- Deposit/Withdrawal Fees: ACH deposits/withdrawals: 0% fee. Debit‑card deposits: 2% fee.

- Example: If you trade US$100 in a contract, you might pay ~US$2 platform fee + any spread. If you deposit via debit card, expect US$2 fee on US$100 deposit.

Comparison Table

| Platform | Key Strengths | Key Weaknesses | Typical Fees / Pricing* |

|---|---|---|---|

| Polymarket | Simple UI, no trading fee, broad event variety | Regulatory uncertainty; liquidity can vary | 0% trading fee. Deposit/withdrawal: ≥ US$3 or 0.3% relayer cost. |

| Limitless Exchange | Multi‑outcome markets, share splitting, LP rewards | Smaller user base; more advanced mechanics for new users | No public flat “platform fee.” Users pay market spread & network gas (~US$0.10‑US$1). |

| Opinion | AI‑driven insights; BNB Chain; fast/low‑cost transactions | Early stage; lesser liquidity; evolving regulation | Fee schedule not publicly well documented. Network cost on BNB Chain: ~US$0.10‑US$1. |

| Kalshi | Fully regulated (CFTC); real‑world event contracts | U.S.-centric; higher fees; limited event flexibility | Trading fee: up to ~2% per contract. ACH deposit/withdraw: 0%. Debit‑card deposit: ~2%. |

Conclusion

In conclusion, each prediction market platform—Polymarket, Limitless, Opinion, and Kalshi—caters to different user needs. Polymarket offers simplicity, low fees, and a broad range of events, but faces regulatory challenges. Limitless stands out with innovative features like multi-outcome markets and liquidity rewards, but is still growing. Opinion uses AI and operates on the fast, low-cost BNB Chain, though it’s in early stages. Kalshi provides regulatory certainty and real-world financial contracts but comes with higher fees and limited market access. The ideal platform depends on whether users prioritise ease of use, advanced features, regulatory compliance, or low fees.

Frequently Asked Questions (FAQs)

What is Polymarket and how does it work?

Polymarket is a decentralised prediction market platform where users trade shares on the likelihood of various real-world events. It allows users to buy and sell “yes” or “no” shares, with prices reflecting the crowd’s probability assessment.

What makes Limitless Exchange unique?

Limitless Exchange offers advanced features like multi-outcome markets, share splitting, and liquidity rewards. Built on Base Layer-2, it provides fast transactions and low fees but is still growing in terms of liquidity and user adoption.

How does Opinion use AI in prediction markets?

Opinion integrates AI-driven insights to help users make informed predictions. By analysing data trends, the platform enhances prediction accuracy. It operates exclusively on the BNB Chain, offering low-cost transactions and fast performance.

Is Kalshi regulated?

Yes, Kalshi is fully regulated by the U.S. Commodity Futures Trading Commission (CFTC). It offers financial contracts based on real-world events, providing users with a compliant, secure platform for trading predictions on a variety of topics.

Which platform is best for beginners?

Polymarket is best for beginners due to its simple, user-friendly interface and lack of trading fees. Its easy-to-use platform and broad event selection make it ideal for those new to prediction markets.