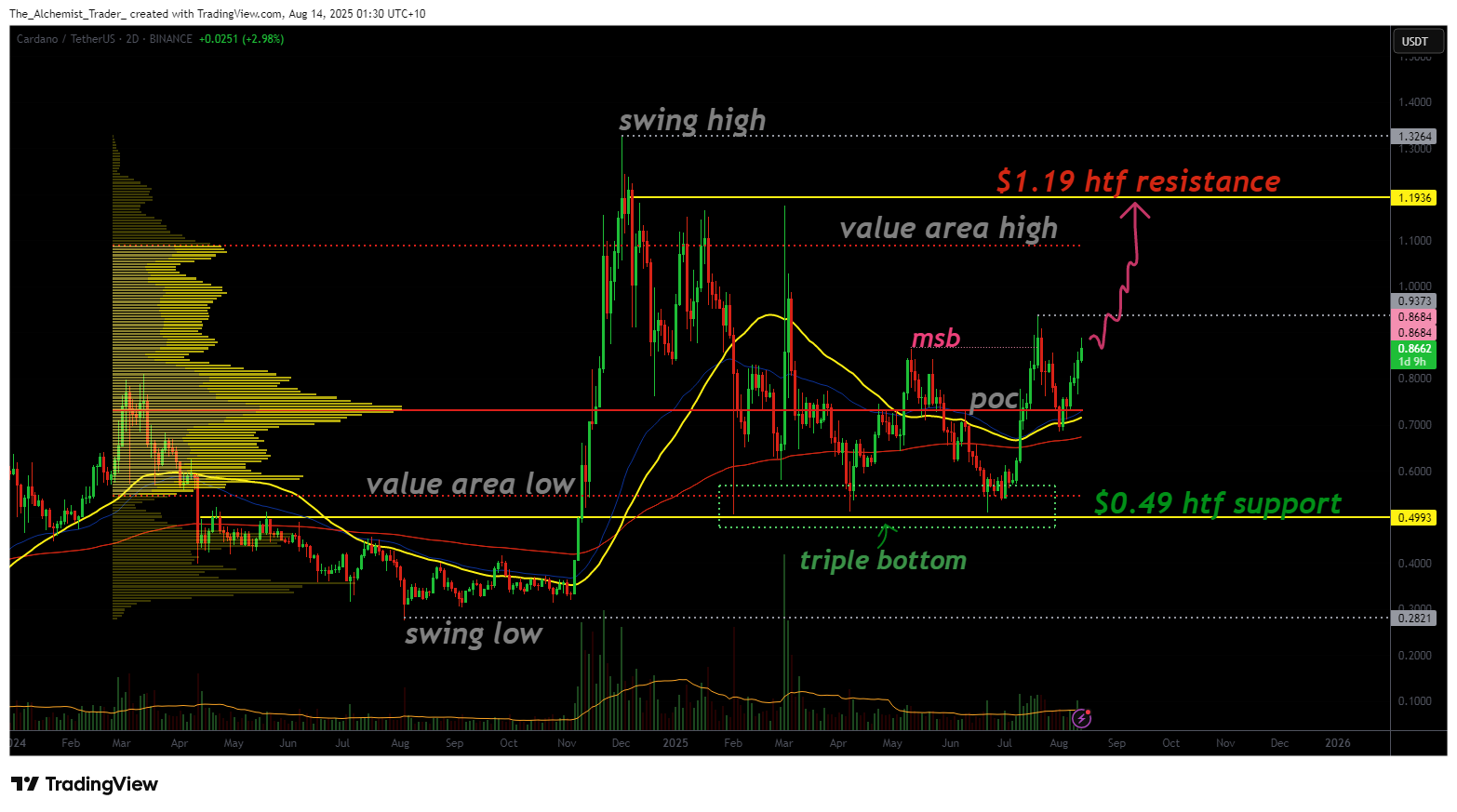

Cardano has surged 11.58%, breaking out from a well-defined technical base. The move follows a triple bottom pattern at $0.49 and a reclaim of key market levels, signaling that upside potential remains strong.

Summary

- ADA surged 11.58% after a triple bottom at $0.49 triggered a breakout.

- Reclaim of the point of control confirms bullish market structure.

- Declining volume profile signals a potential bullish influx toward $1.19 and $1.32.

Cardano’s (ADA) rally began from a crucial confluence of support levels, combining the point of control and the 50-day moving average. This reaction has shifted market structure back to bullish territory, with higher highs and higher lows re-established on the daily chart. As price approaches major high time frame resistances, the market’s next move will depend on whether ADA can sustain its momentum and break through these levels with conviction.

Key technical points

- Triple Bottom Formation at $0.49: Established at the value area low, providing a strong reversal base.

- Reclaim of Point of Control: Aligned with the 50-day moving average, confirming renewed bullish strength.

- Upside Targets: $1.19 high time frame resistance and $1.32 swing high remain the next key levels to test.

The bullish breakout followed a decisive reaction from $0.49, where ADA established a triple bottom, a pattern widely viewed as a powerful reversal signal. This level also coincided with the value area low, making it a high-probability buying zone. Once price reclaimed the point of control and successfully retested it, buyers stepped in with strong momentum, pushing ADA toward a zone of prior structural breakdown.

Reclaiming the point of control not only restored bullish sentiment but also returned ADA to the upper half of its current trading range. This shift increases the probability of a full rotation toward the value area high at $1.19. Historically, ADA has shown strong follow-through once it regains control of this volume node, and current momentum suggests the pattern could repeat.

From a market structure perspective, ADA remains firmly bullish. The ongoing higher high and higher low sequence confirms trend continuation, while the 50-day moving average acts as dynamic support. In previous cycles, this moving average has repeatedly served as a springboard for upward moves, making its current confluence with the point of control a key bullish factor.

The volume profile also paints a constructive picture. While total trading volume has declined during this rally, a sign that price may be coiling before its next move. The expectation is for a bullish volume influx once ADA reaches resistance. A climatic bullish node at $1.19 could trigger the breakout necessary for an extension toward $1.32, the next high time frame resistance.

What to expect in the coming price action

As long as $0.49 holds as high time frame support, ADA’s bullish market structure remains intact. A close above the current swing high would likely spark an accelerated rally toward $1.19. If this resistance is broken with strong bullish volume, the path toward $1.32 becomes highly probable.