Injective price was down nearly 5% in 24 hours as the cryptocurrency experienced slight sell-off pressure following a sharp surge amid exchange-traded funds news.

Summary

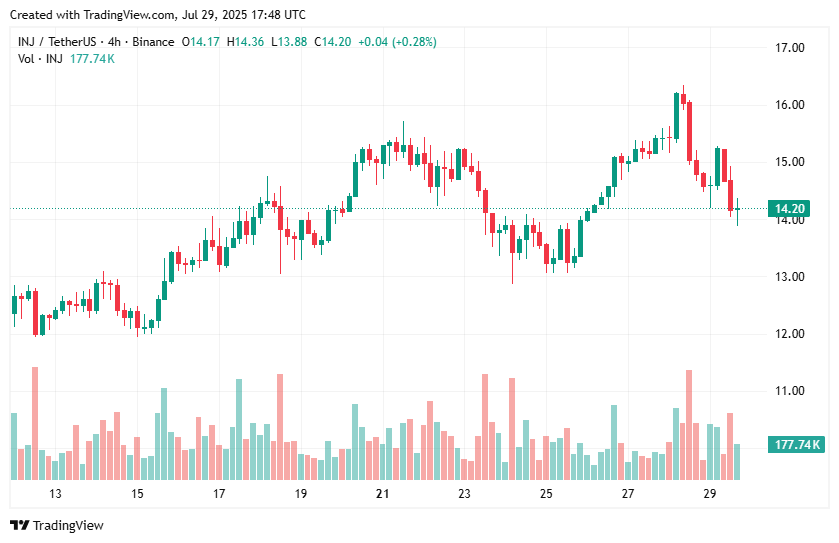

- Injective price retreated slightly on July 29, falling about 5% as INJ touched lows of $13.88.

- The altcoin has surged on Monday amid news that Cboe had filed for the listing of the Canary Capital Staked Injective ETF.

- Institutional interest in INJ remains as the market eyes regulatory approvals for staked crypto ETFs, including for Ethereum and Solana.

The price of Injective (INJ) soared from lows of $14.48 to above $16.35.

However, after giving up some of the upside amid broader market struggles, INJ has extended the retreat. The coin touched lows of $13.88.

Market data on crypto.news showed Injective price hovered around $14.31, below the intraday low on July 28 and at risk of further losses as top cryptocurrencies face downside pressure.

Why did Injective surge?

Injective’s gains came as traders reacted to news that Cboe, the largest options exchange in the United States, had filed with the U.S. Securities and Exchange Commission for approval to list the Canary Capital’s Staked Injective exchange-traded fund.

The CBOE has filed to list the Canary $INJ Staked ETF in the U.S.

The @CBOE is the largest options exchange in the United States of America.

Injective's institutional adoption is accelerating like never before. pic.twitter.com/kWaDE1S1B0

— Injective 🥷 (@injective) July 29, 2025

The filing meant Canary’s staked Injective ETF joined other major staked crypto ETF flings – Ethereum (ETH) and Solana (SOL). It also points to the growing interest in Injective by institutional investors, which follows Canary’s registration of Delaware trust for the INJ ETF.

As the market reacted to the filing news, INJ price rose. However, like in many instances across the ecosystem, buy the rumor and sell-the-news scenario appears to have allowed for profit-taking.

INJ is not down by much, but price is hovering near a key level and fresh declines will push it support around $13.20.

Despite the declines, analysts have pointed to Injective protocol’s price as signaling a bullish pennant on higher time frames.

Injective longs liquidated

Data from Coinglass shows a total of over $982,000 in Injective positions have been liquidated in the past 24 hours.

Of this, the vast majority are bullish bets at more than $895k. This liquidation hit for longs, with only $87k in shorts wiped out, also sees a decrease in open interest.

Coinglass data also indicates a decline of 10.4% in Injective OI, currently at around $167 million. Meanwhile, derivatives volume has fallen 16% to $413 million.