Solana could be on the verge of a rally to $164 soon as it looks poised to break out of a popular bullish pattern, according to an analyst.

According to a July 9 post on X by analyst Ali, Solana has formed a symmetrical triangle pattern on the 4-hour chart, characterized by two converging trendlines representing lower highs and higher lows. Such a pattern suggests a period of price consolidation that typically culminates in a breakout in either direction.

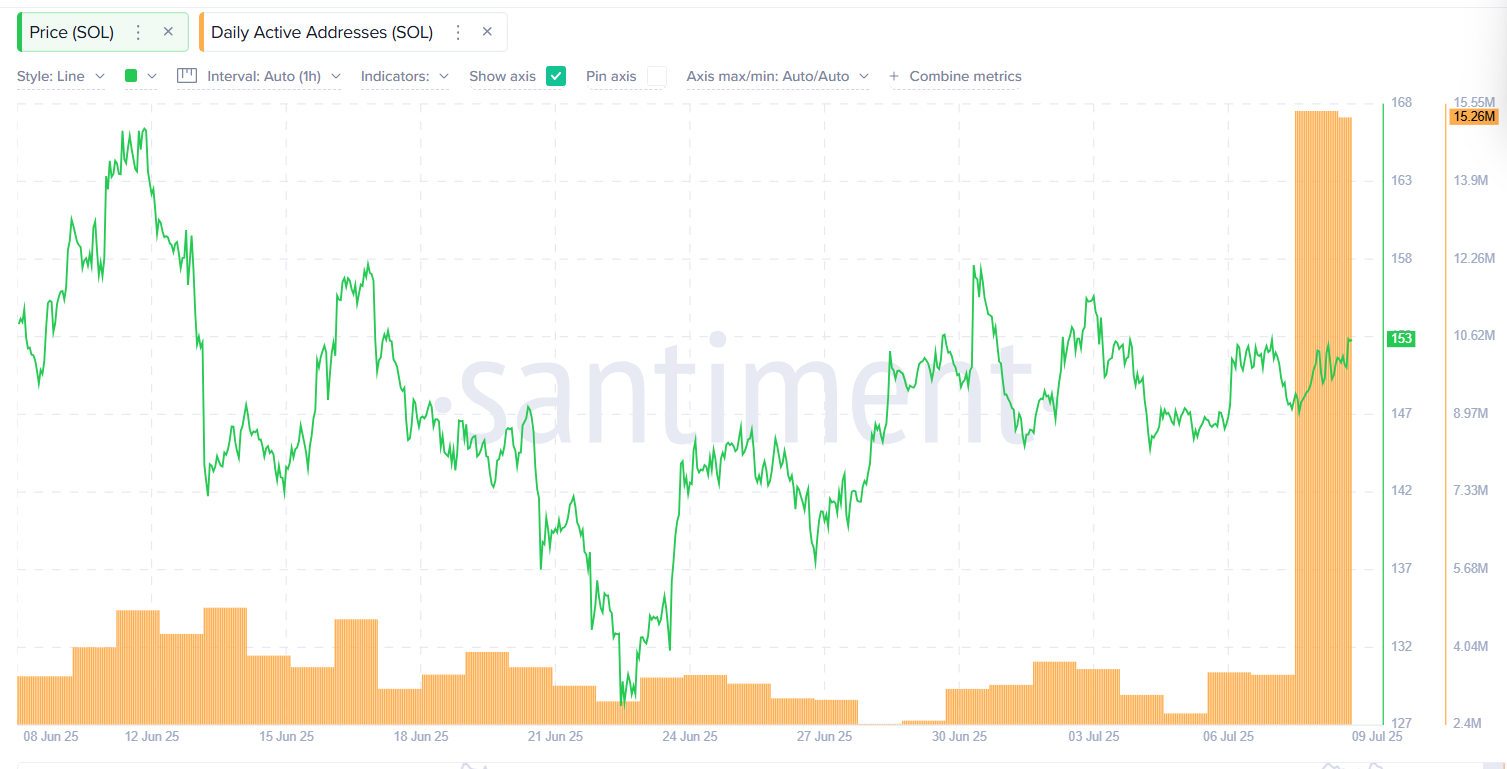

Ali noted that a confirmed breakout above the upper boundary of the pattern, located near the $153 resistance level, could trigger a bullish move with a short-term target of $164.

As of press time, Solana (SOL) was trading exactly at this key threshold, setting the stage for a potential technical breakout.

Momentum indicators support the bullish outlook. On the 4-hour/USDT chart, the Moving Average Convergence Divergence line has crossed above the signal line, with both trending upward. Traders view this as a sign that buying interest is picking up, and the price may continue to rise.

Additional technical insights were provided by another pseudonymous analyst, SDX, who observed that SOL has been coiling below a descending trendline formed since the beginning of the year.

A successful breakout and retest of this level, SDX notes, could act as a catalyst for a stronger uptrend, potentially opening the door to a new all-time high if buying volume confirms the breakout.

Fundamentals are also panning out in Solana’s favor. First, SOL was recently included as one of the featured assets in Trump Media and Technology Group’s proposed “blue-chip” cryptocurrency ETF, according to a filing with the U.S. SEC.

Second, reports indicate that the U.S. SEC has requested issuers to amend and resubmit applications for spot Solana ETFs by the end of July, potentially accelerating the timeline for formal approval. When the SEC makes such a request, it typically signals that the agency is not rejecting the proposals outright but is open to moving forward if certain conditions are met.

Traders often view this kind of regulatory engagement as a bullish sign, interpreting it as a step closer to approval that could unlock fresh demand from institutions and retail investors alike.

Meanwhile, Solana has also emerged as a leading blockchain in the real-world asset tokenization sector. Data from Dune Analytics shows that tokenized RWAs on Solana reached a record $418 million, with a 631% increase in active users over the past 30 days.

This is further backed by strong network activity. Daily active addresses for Solana shot up to 15.39 million from just 3.46 million the previous day, marking a dramatic 345% increase in network activity.

Stablecoin supply on the Solana network has also steadily increased over the past week. Stablecoins are the backbone of decentralized finance, serving as a critical medium of exchange, store of value, and unit of account within blockchain ecosystems.

For Solana, this could mean an influx of new users is leveraging the chain for payments, trading, and tokenized asset settlements, which in turn can further support the bullish narrative.

SOL was trading roughly 48% below its all-time high of $293 at press time.