A Deloitte report explains that asset tokenization is opening up major opportunities for real estate investment.

Asset tokenization is one of the biggest potential use cases for crypto. On Thursday, April 24, global management consulting firm Deloitte published its FSI Predictions 2025 report, focusing on the growth potential of the real-world asset industry in real estate.

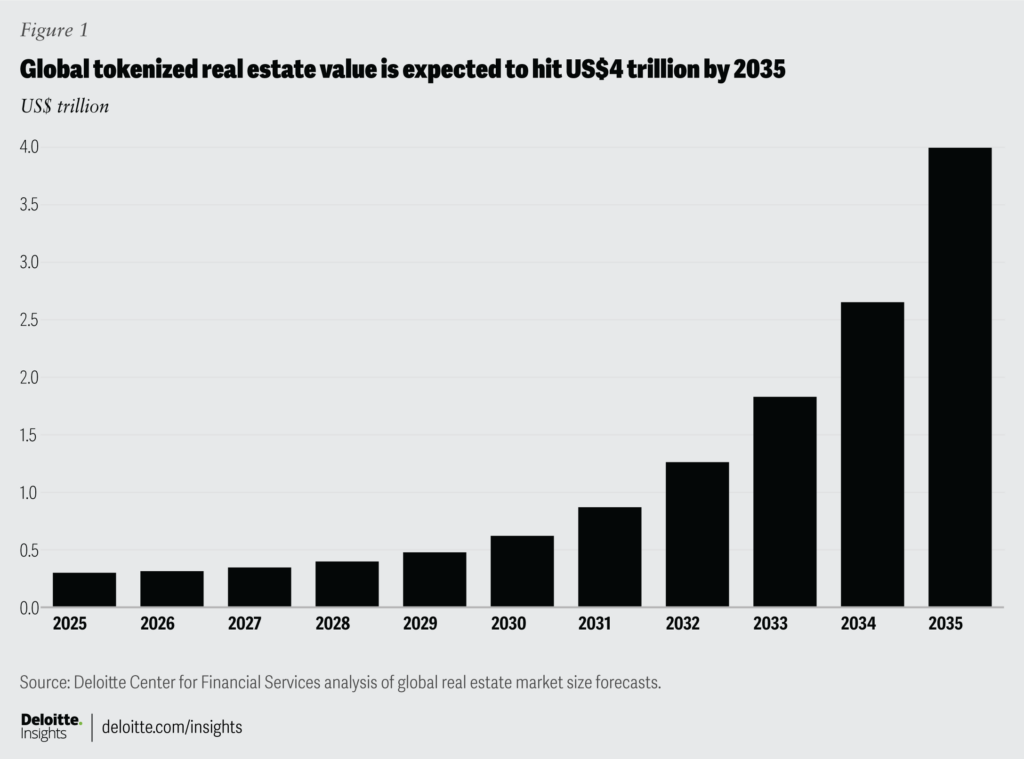

Deloitte predicts that the value of tokenized real estate will reach $4 trillion by 2035, reflecting a 27% compound annual growth rate from current levels. Even today, tokenized real estate is already a big business, with an asset value of $300 billion in 2024.

Out of the projected $4 trillion figure, $1 trillion will likely be in tokenized private real estate funds. So far, these funds have only been accessible to accredited investors. However, asset tokenization could make them accessible to all types of investors.

Tokenized real estate shows major potential: Deloitte

Instead of traditional shares, investors would receive tokens representing ownership in the fund. Tokens could even represent a specific portion of a fund’s real estate portfolio and could be easily tradable. This would make entry and exit from investments easier.

Another $2.39 trillion is expected to be tied to tokenized loans in securitization by 2035, capturing around 0.55% of the market. This is equivalent to mortgage-backed securities, a major segment of the financial markets. Deloitte suggests that tokenization could enable real-time payment data, reduce costs, and improve traceability.

Tokenization in this market offers major advantages over the traditional model, Deloitte explains. For one, blockchain technology can significantly reduce administrative costs, which are a major burden for the industry. At the same time, it expands investor access, making funds accessible to global and retail investors.

Still, Deloitte also highlights certain risks and questions the industry needs to address. For one, there are concerns around custody, accounting practices, and what happens in the event of a default. Additionally, cybersecurity may pose a major threat to the emerging tokenized real estate industry.